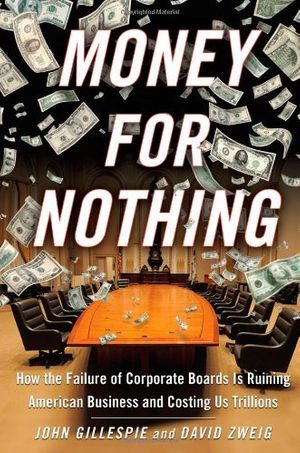

Money for Nothing

John Gillespie

A Bank of America director questioned the CEO's $76 million pay package in a year when the bank was laying off 12,600 workers and found herself dropped from the board without notice a few months later. According to their employment agreements -- approved by boards -- 96 percent of large company CEOs have guarantees that do not allow them to be fired "for cause" for unsatisfactory performance, which means they can walk away with huge payouts, and 49 percent cannot be fired even for breaking the law by failing in their fiduciary duties to shareholders. The General Motors board gave CEO Rick Wagoner a 64 percent pay raise -- to $15.7 million -- in 2007, when the company lost $38.7 billion. The company went bankrupt two years later at a cost of $52 billion to shareholders and another $13.4 billion to all taxpayers. If you own stock -- and 57 million U.S. households do -- every cent of these outrages comes out of your pocket, thanks to boards of directors who are supposed to represent your interests. Every customer, employee, and taxpayer is also being hurt and American business is being imperiled. In the most recent economic collapse, almost all attention has focused on the greed, recklessness, or incompetence of CEOs rather than the negligence of boards, who ought to be held equally, if not more, accountable because the CEOs theoretically work for them. But the world of boards has become an entrenched insiders' club -- virtually free of accountabil

Booko found 5 book editions

Product filters

| Product |

Details

|

Price

|

New

|

Used

|

|---|---|---|---|---|

|

|

New: Being refreshed...

Used: Being refreshed...

|

New: Being refreshed...

Used: Being refreshed...

|

Being refreshed... | Being refreshed... |

|

|

New: Being refreshed...

Used: Being refreshed...

|

New: Being refreshed...

Used: Being refreshed...

|

Being refreshed... | Being refreshed... |

|

|

New: Being refreshed...

Used: Being refreshed...

|

New: Being refreshed...

Used: Being refreshed...

|

Being refreshed... | Being refreshed... |

|

|

New: Being refreshed...

Used: Being refreshed...

|

New: Being refreshed...

Used: Being refreshed...

|

Being refreshed... | Being refreshed... |

|

|

New: Being refreshed...

Used: Being refreshed...

|

New: Being refreshed...

Used: Being refreshed...

|

Being refreshed... | Being refreshed... |

Booko collects this information from user contributions and sources on the internet - it is not a definitive list of editions. Search Booko for other editions of Money for Nothing.